'Soul-crushing': RBA leaves interest rates on hold in surprise decisio…

The Reserve Bank of Australia (RBA) has left interest rates on hold at 3.85 per cent, defying the expectations of economists and struggling mortgage holders, and admitted there might not be too many more cuts still to come.

The central bank was widely anticipated to cut the cash rate target today, which would have seen interest rates cut in successive meetings for the first time since March 2020.

But in handing down its monetary statement, the RBA Board said it would "wait for more information" before moving the cash rate target.

READ MORE: Former radio host sues broadcaster over infamous 2012 royal prank

"The Board continues to judge that the risks to inflation have become more balanced and the labour market remains strong," the board said.

"Nevertheless it remains cautious about the outlook, particularly given the heightened level of uncertainty about both aggregate demand and supply.

"The Board judged that it could wait for a little more information to confirm that inflation remains on track to reach 2.5 per cent on a sustainable basis.

"It noted that monetary policy is well placed to respond decisively to international developments if they were to have material implications for activity and inflation in Australia."

READ MORE: Lawyer has 'grave concerns' about legality of raid in Alan Jones sexual abuse case

RBA might not hand down many more cuts

Speaking to reporters following the monetary policy board's decision, Governor Michele Bullock said the RBA might not cut rates too much further, at least not compared to what other nations' central banks have done.

"The board's strategy has been to bring inflation down while avoiding a sharp rise in unemployment," Bullock said.

"This strategy has meant that we didn't take rates as high as some other countries, and so it may be that we don't need to reduce rates as much as some other countries have done."

That wasn't to say, though, that another rate cut has been ruled out, with Bullock saying that the split, 6-3 decision to keep rates on hold was more due to timing than the overall inflation picture in Australia.

READ MORE: Bendigo Bank to shut 10 branches across three states

The RBA didn't have any new quarterly inflation data to assess following the last rate cut in May (that gets released in a few weeks), and the next meeting is little more than a month away.

"The board's decision today was recognising that, look, there's a few weeks, five weeks, until the next meeting... the difference in opinion amongst the board wasn't so much directionally, it was about timing," Bullock said.

She also denied the hold was just a case of the RBA keeping its powder dry in case a negative shock – such as the breakout of a severe trade war – hits the Australian economy.

"Pre-COVID, interest rates were down... we had hardly any room to move.

"So all I'm saying is if something bad does happen, we have more room to move.

"But we are not deliberately holding interest rates higher in order to give ourselves more power."

READ MORE: Mushroom murder victims' church shares message after guilty verdicts

'Soul-crushing' to think relief is coming: Experts

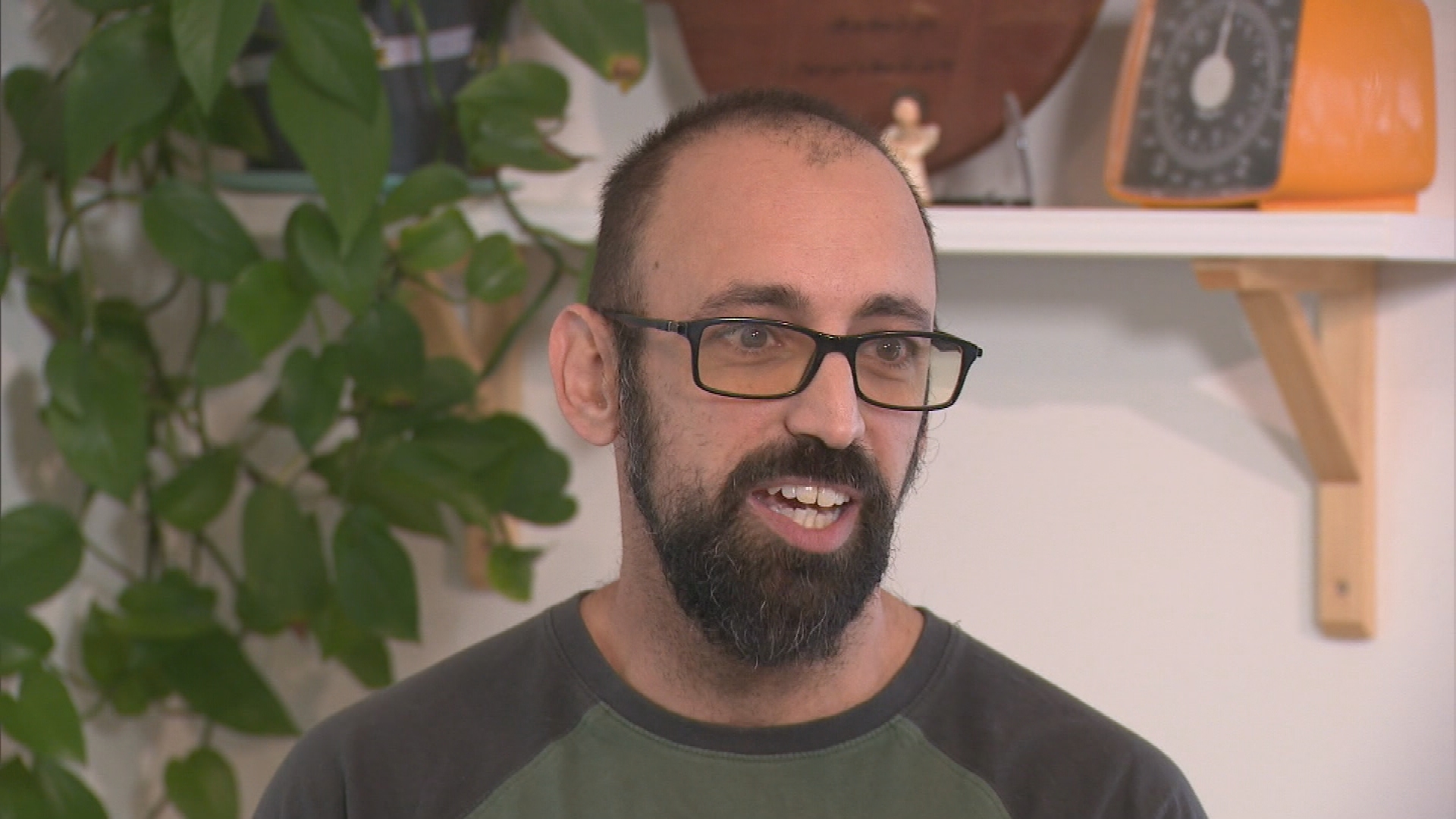

Head of consumer research at Finder Graham Cooke said many buyers were all but relying on an interest rate cut.

"There is still a portion of homeowners who are in severe mortgage stress doing it tough," Cooke said.

"It's soul-crushing when you think relief is coming only to find that you need to wait another couple months.

"Cut or not, there is still a significant difference between the average and lowest rate available."

9News finance editor Chris Kohler said today's decision will send experts "back to the drawing board".

"We're expecting these tight monetary policy conditions to be eased now that we've vanquished, essentially, this inflation demon that we've been battling," Kohler said.

"Now, not only were the big economists expecting today to be an interest rate cut, but they were expecting multiple rate cuts for the rest of this year, anywhere between one and three more on top of today.

"So now they're really going to have to go back to the drawing board and decide what is Michele Bullock's game plan here, what are we doing?"

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.